The growth of alternative energy sources have been fueled through subsidies by countries across the globe. Emerson’s Douglas Morris, a member of the alternative energy industry team, shares the latest developments in wind energy sources, here in the United States.

There are certainly no shortage of articles and opinions about alternative energy’s difficulties. This week, though, I noticed two articles that really emphasize the realities of the industry and how these realities are affecting investment from developers and equipment suppliers. In particular, the wind players may find it especially hard over the next half year.

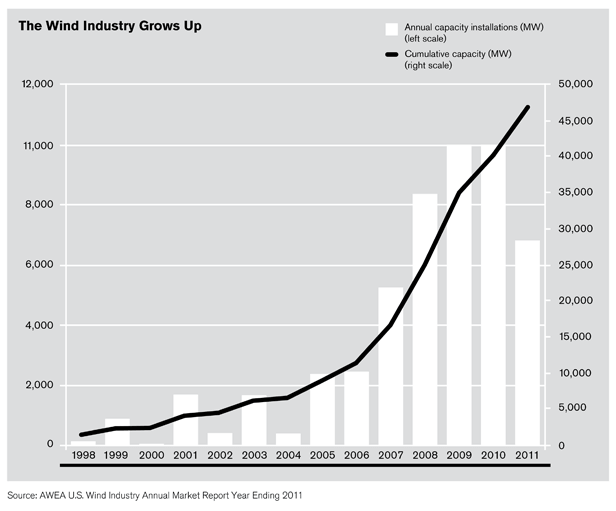

Wind represents about 5 percent of the installed capacity in the US, which currently stands at about 1,000 GW. Any industry would appreciate the growth shown in the past decade.

The nice growth curve shown above may come to an abrupt stop by the end of the year, though, if the Renewable Electricity Production Tax Credit (PTC) is not renewed. Investment was strong the first part of 2012, but with the uncertainty about this regulatory decision looming, investment is slowing and some planned projects have been cancelled as a result. But support for the PTC has ebbed and flowed since it first became available in 1992 so uncertainty can’t be the only reason.Beyond the PTC, the recurring theme of cheap natural gas is certainly influencing investment decisions. I think the next factor is the investment community has grown more wary about putting their money into projects that aren’t profitable on their own. This CNN Money article does a good job summarizing this and it’s the first time I can recall hearing the word “toxic” attached to investments in alternative energy.

It’s no surprise that this slowdown has made its way to manufacturers. The world’s largest wind turbine supplier, Vestas, just announced another set of layoffs to help bring it back to profitability.

“The company said this will help ensure profitability in 2013, when the wind-turbine sector is facing a massive downturn due to macroeconomic headwinds and the threatening expiration of a U.S. tax credit on wind-power production.”

The next 6 months and beyond will be turbulent for this industry. But, wind turbines are not going away any time soon as they’ve been embraced as a viable part of the generation mix required for power producers to manage cyclicality.