Emerson’s Alan Novak, leader of the alternative energy and metals & mining industry teams, offers his thoughts on the reemergence of $100 USD/barrel oil.

While no one was looking, oil (West Texas Intermediate – WTI) has slowly crept back to $100/barrel (WTI reached it last week, Brent crude has been above that level since March of 2011).

Since the Western economies remain in the doldrums, what is driving the increase? Principally continued strong global demand and declining US stocks. Some interesting perspectives appeared in the Wall Street Journal on November 4. In the chart, the authors note, “Crude-oil prices on the New York Mercantile Exchange are picking up… as petroleum inventories in the U.S have started to decline.“

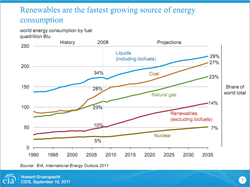

The latest U.S. Energy Information Agency International Energy Outlook highlights both the increasing global energy demand and the projected demand for alternative sources of liquid fuels:

At the same time new (albeit more expensive) reserves, such as Anadarko’s 1 billion barrel shale oil find in Colorado, continue to be discovered.

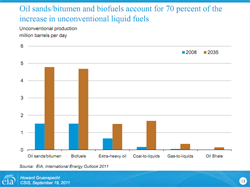

Challenges exist even where additional supply is available. Disagreements have surfaced over increased supply of Canadian oil sands production to the US (the Keystone XL pipeline debate), which is prompting Canadian producers to re-examine their commitment to the US market (Canada currently supplies about 7% of US oil).

As we mentioned in a post a few weeks ago, demand in the developing world (principally China and India) continues unabated and they are aggressively moving to develop all available domestic energy resources. New oil reserves in all parts of the world will be either more difficult to extract (oil sands, shale, etc.) or in more challenging locations (deepwater). Efforts to develop other non-conventional sources of liquid fuel (coal, natural gas and biomass) are gaining increasing traction as the price spread between a BTU of crude and a BTU of alternatives continues to expand. The price spread between the base feedstocks now offsets the added conversion costs of crude oil alternatives.

So, what does it all mean? The global demand for liquid fuels to supply the existing (conventionally fueled) transportation fleet will continue its strong growth for the foreseeable future. With crude prices on the rise, both unconventional crude supplies (shale, deepwater, oil sands) and unconventional liquids (natural gas liquids, biofuels, gas to liquids and coal to liquids) will play increasingly important roles in meeting the demand.

Whether the U.S. will choose a course of greater self-sufficiency, greater reliance on our neighbors to the north, or increasing imports of oil from outside North America remains to be seen.