In an RBN Energy blog post, The Yellow Rose Of Texas: Battle Of Texas Ethane Begins As Cargo #1 Departs Morgan’s Point, it not only gives a great history lesson on the origins of the Yellow Rose of Texas, but also the market dynamics for ethane production. It highlights the challenge that shale gas production has created for midstream producers:

That’s because the Shale Revolution led to huge increases in wet natural gas production and, with that, far more ethane than the U.S. petrochemical market was prepared to consume. That, in turn, resulted in massive ethane “rejection” – or leaving ethane in the gas stream and selling ethane at gas prices rather than selling it as a “purity” product for use as a cracker feedstock…

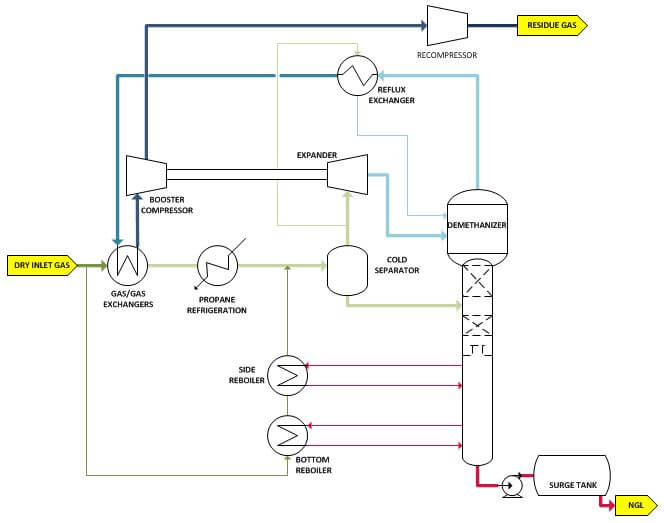

I caught up with Emerson’s Lou Heavner on the control challenge in switching between ethane recovery and ethane rejection based on market prices for ethane. Lou noted that at the heart of the gas plant is the cryogenic turboexpander (TE) process and de-methanizer.

A gas plant is a series of distillation column separation processes. The first column, the de-methanizer removes methane (C1) out of the top of and everything else—ethane (C2), propane (C3), butane (C4), etc. the natural gas liquids (NGLs)—out of the bottom. As with virtually any distillation process, there are quality limits on both the column overhead and bottom purities. Typically, the overhead product (residue gas) has a specification for BTU content or Wobbe index. There may be economically based specifications for C3 or other quality measures. The bottom specifications are typically C1 and C1/C2 ratio. The relative value of the overhead (distillate) product vs the bottom product sets the targets.

When ethane is more valuable than methane, the separation process runs in ethane recovery mode. Its recovery is maximized by minimizing the amount of ethane that leaves the top of the de-methanizer. This is usually defined as a BTU lower limit on the residue (sales) gas, also known as methane, leaving the top.

When ethane is more valuable than methane, the separation process runs in ethane recovery mode. Its recovery is maximized by minimizing the amount of ethane that leaves the top of the de-methanizer. This is usually defined as a BTU lower limit on the residue (sales) gas, also known as methane, leaving the top.

On the other side, when ethane prices approach methane prices, the separation process runs in ethane rejection mode. The control objective is to allow ethane to slip out the top of the de-methanizer, which reduces the amount of energy required to purify the residue gas stream and also unloads the next column, the de-ethanizer, if the gas plant has one.

This is accomplished by maximizing the BTU content of the sales gas subject to a propane constraint, since propane and higher hydrocarbons may also slip into the residue gas stream. Since propane is always more valuable than methane, the objective is to keep propane slip to a minimum.

Lou noted that there are two controlling specifications at the bottom of the de-methanizer—methane in the bottom and methane/ethane ratio in the bottom, which are always maximized to the spec limits. These objectives are achieved by configuring them in the embedded linear program (LP) optimizer that is part of DeltaV PredictPro. The MPCPro Operate window has a drop down where the operator can select the desired objective function, in this case ethane recovery or ethane rejection.

Moving down the train of distillation columns in plants with a fractionation train—de-ethanizer, de-propanizer, de-butanizer, etc., similar pairs of objectives can be set, based on the economic value of the hydrocarbons being separated. For example, in the de-propanizer, propane is removed from the top and butane and heavier (C4+) leaves the bottom. If propane were more valuable than butane, we would want to let as much butane slip out with the propane as possible and minimize the propane lost in the bottom C4+ stream. If conditions were reversed with butane more valuable, we would maximize propane slip in the butane and minimize butane loss in the propane.

The handles for any of these distillations are essentially the same, where reflux at the top and reboil heat at the bottom are used to control the compositions. They must be coordinated with each other and with pressure and level controls in the column and in the reflux accumulator.

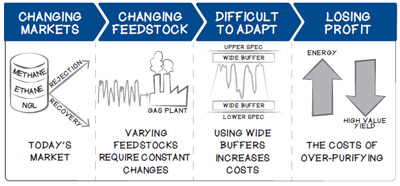

Lou noted that in most gas plants that do not use advanced control strategies that operators tend to overpurify and give up on recovery. Using advanced process control technologies, such as the model predictive control (MPC) technology in PredictPro, also generally improves the stability of the process and enhances the ability of the process to recover from a disturbance.

It is important to remember that ethane prices are dynamic. Low prices today may turn into high prices tomorrow and back to low prices again in the future. Gas processors with the most flexibility to switch between ethane recovery and ethane rejection will have the advantage when ethane prices fluctuate. When optimized, typical project return on investments can be on the order of 6 months.

Lou and the other advanced process control consultants can help scope and execute the project to provide your gas plant the flexibility to rapidly adapt to changing market conditions. You can also connect and interact with other control experts in the DeltaV and Improve & Modernize groups in the Emerson Exchange 365 community.