Emerson’s Janine McCormick, Metals and Mining industry manager for the Fisher Valve & Instruments business unit, shares some of the reasons behind gold’s price appreciation and how mining companies are reacting.

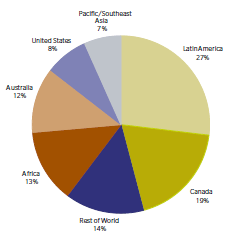

While the golden tickets found in candy bars in Roald Dahl’s Charlie and the Chocolate Factory were a highly sought-after item, the real life demand for gold is seeing a strong increase. This is mainly due to the rapid expansion of a middle class in India, throughout the rest of Asia, Latin America, and Eastern Europe.

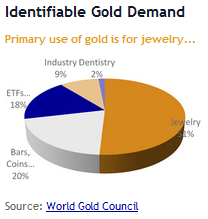

The primary areas for gold demand are in the form of jewelry and investment. Jewelry is still seen as a luxury item and as the middle class continues to grow around the world, so will the demand for gold.As for gold being used as an investment, it has often been called the “crisis commodity” because it tends to outperform other investments during periods of world or economic tensions.

The demand for gold has allowed this precious metal to regain its standing as the top exploration target. It only had a recent fall in 2008, but other than that, it has been the top exploration target (by percentage) for over 20 years.Over the years, gold prices have increased a staggering 350% since 2001. During this time, gold mine supply has been flat. This limited supply has been a contributing factor in gold’s sustained price gains.

There have been some growth projects but these will be largely offset by the continued decline in output from aging South African, U.S., and Australian gold mines. As a result, to maintain current levels of supply and account for growing levels of demand, there are numerous gold projects in the funnel for the coming years.

Based on the level of demand, price appreciation, and exploration efforts, it looks like the major metals & mining companies are looking to quite literally; strike gold in the next several years.